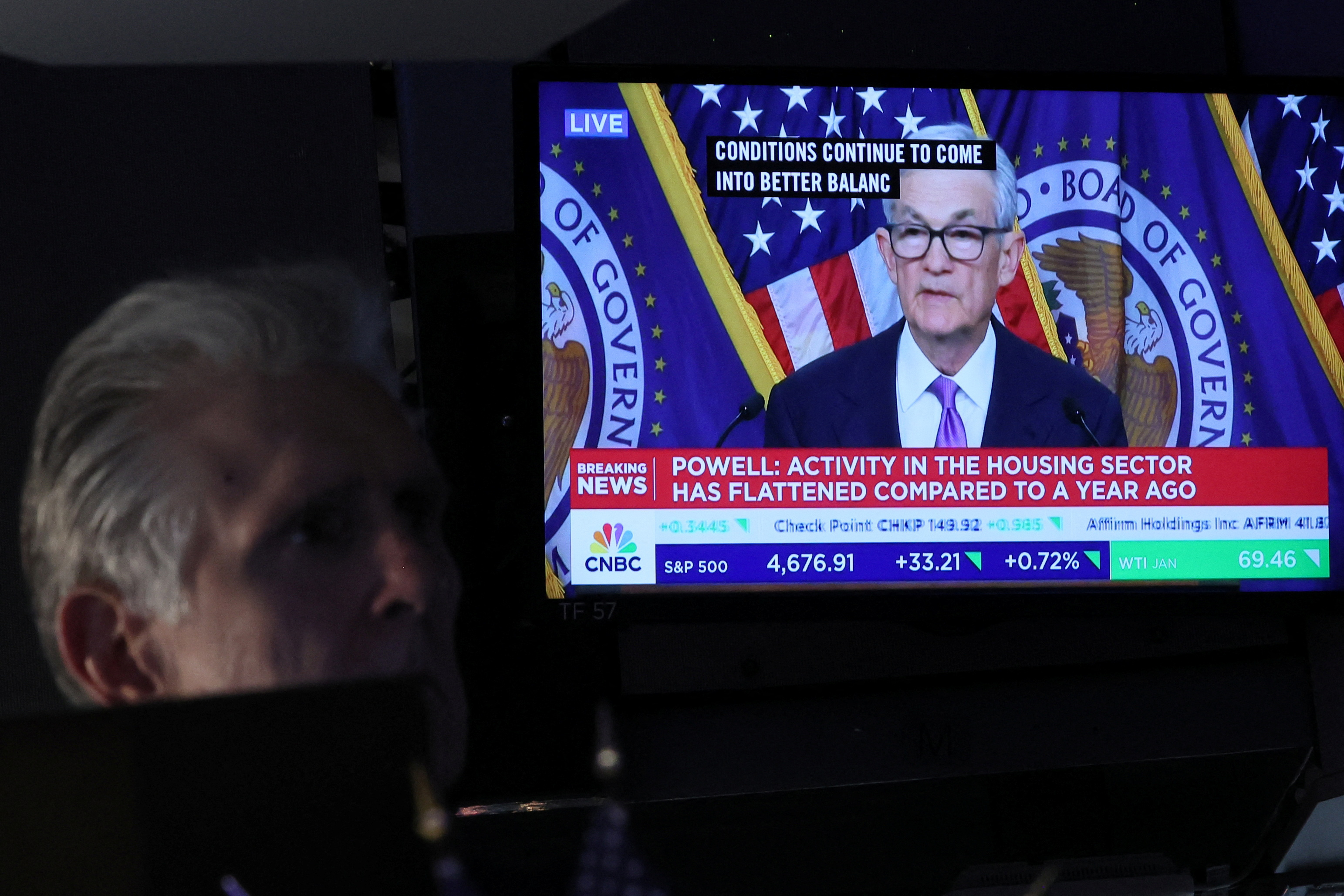

The stock market has been experiencing a notable surge, with the Dow Jones Industrial Average nearing all-time highs, propelled by a widespread belief among investors that a series of interest rate cuts from the Federal Reserve is on the horizon. This sense of anticipation, often referred to as “rate-cut fever,” has become a dominant force on Wall Street. It is driving investor behavior and reshaping expectations for the economic landscape in the coming year. The market’s enthusiasm is a powerful signal of its confidence that the central bank will soon shift its monetary policy from a restrictive stance to a more accommodative one, a move that would provide a significant boost to corporate earnings and overall economic activity.

The recently emerged optimism is a sharp contrast to the state of affairs several months prior, when ongoing inflation and an aggressive Federal Reserve capped market growth. The turnaround in outlook is linked to a number of crucial economic statistics indicating a reduction in inflationary pressures and a gentle easing in the job market. Investors view these signs as an approval for the Fed to start reducing borrowing rates, an action likely to lower investment costs for businesses and consumer expenses. This scenario has generated a strong boost for stocks, as market actors hurry to prepare for a renewed phase of more lenient monetary policy.

The allure of lower interest rates is particularly strong for high-growth sectors, such as technology and real estate. These industries are highly sensitive to the cost of capital, and a reduction in rates would make their future earnings streams more valuable in today’s terms. It also makes debt more affordable, encouraging companies to expand and innovate. This is one of the primary reasons why the Nasdaq Composite, which is heavily weighted toward technology stocks, has also seen significant gains alongside the Dow. The market is effectively pricing in a future where capital is more abundant and less expensive, a scenario that would favor companies with ambitious growth plans.

However, the current market optimism is not without its risks. The belief that the Fed will cut rates aggressively is based on a number of assumptions that may not hold true. A sudden reversal in inflation trends, a stronger-than-expected jobs report, or any other unexpected economic development could force the central bank to delay or even reverse its plans. Such a change in course would likely send a jolt through the market, potentially leading to a sharp correction. The current environment is therefore a delicate balancing act, with investors betting on a specific outcome while remaining vulnerable to any deviation from that path.

The concept of a “soft landing,” where the Fed successfully tames inflation without pushing the economy into a recession, is the central narrative underpinning the current market rally. This scenario, once considered a long shot, is now seen by many as a likely outcome. The market is essentially celebrating the idea that the Fed has navigated a difficult period with a masterful hand, and that the economy is poised for a period of sustainable growth with lower inflation. This belief, whether it is ultimately borne out by events or not, is a powerful psychological driver that is fueling the market’s ascent..

The rally’s longevity will depend on several key factors. First and foremost is the Fed’s actual policy decisions in the coming months. Any deviation from the anticipated rate cuts could easily spook investors. Secondly, corporate earnings will need to hold up, as a strong market cannot be sustained on sentiment alone. Investors will be watching closely to see if companies can continue to grow their profits in the face of ongoing economic uncertainty. Finally, the geopolitical landscape remains a wild card, with potential conflicts and trade disputes capable of disrupting supply chains and undermining economic stability.

The current market environment is a fascinating case study in the power of expectations. The Dow’s proximity to record territory is not just a reflection of current economic conditions, but of a collective bet on the future. Investors are looking past the present and placing their wagers on a future where inflation is under control and the Fed is actively supporting growth.

Este es un poderoso testimonio de la naturaleza previsora del mercado, pero también subraya su susceptibilidad a giros y vueltas inesperadas. Los próximos meses serán una prueba decisiva para ver si el optimismo actual está justificado o simplemente es un caso de ilusiones. La diferencia decidirá si el Dow se eleva a nuevas alturas o retrocede de su posición actual.